Unmanaged debt causes stress—control it with awareness, planning, and action.

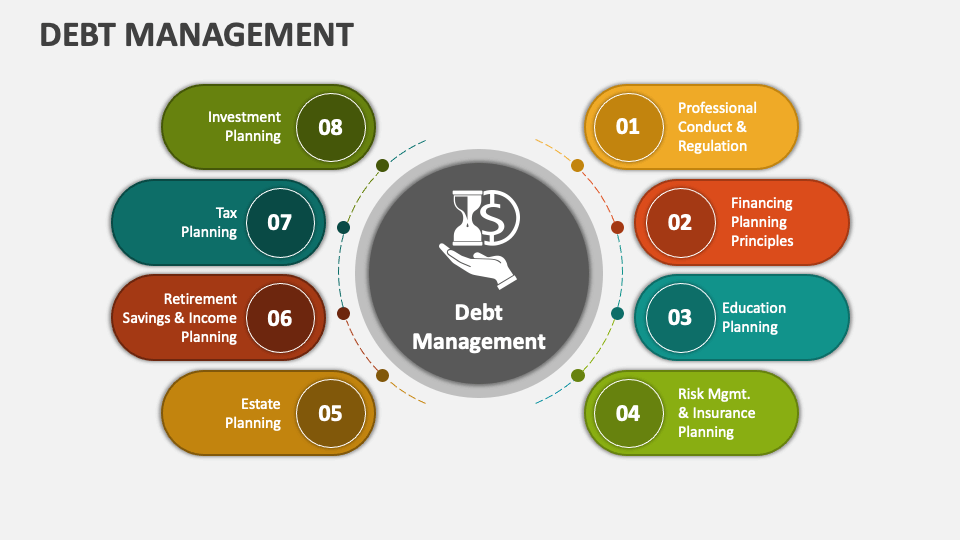

Debt has become a common financial tool, but when left unmanaged, it can lead to anxiety and reduced financial freedom. The key to managing debt lies in awareness, structure, and consistent action.

Make a list of all your debts with interest rates and minimum payments. Awareness is the first step.

Choose a strategy that works for you — either paying the smallest balance first or the one with the highest interest rate.

Consider debt consolidation loans or balance transfers to lower your interest burden and simplify payments.

Set up automatic payments to ensure consistency and avoid late fees or missed due dates.

Talk to financial advisors or credit counselors if your situation feels overwhelming.

Identify all sources of debt

Choose a repayment strategy

Automate and monitor progress

Celebrate small milestones

Achieve financial freedom!

Start small, stay consistent, and watch your debt shrink while your confidence grows.

Talk to an Expert